The government announced recently that it has invested £4.1m in green finance projects. These projects are designed to incentivise and assist homeowners to improve the energy efficiency of their houses. 26 different projects will benefit from the total sum and each one will make it easier for individuals to afford domestic energy upgrades. This particular wave of investment focuses on combining energy upgrade payments and mortgage payments to create affordable options for homeowners.

Why has the government invested in Green Finance Projects?

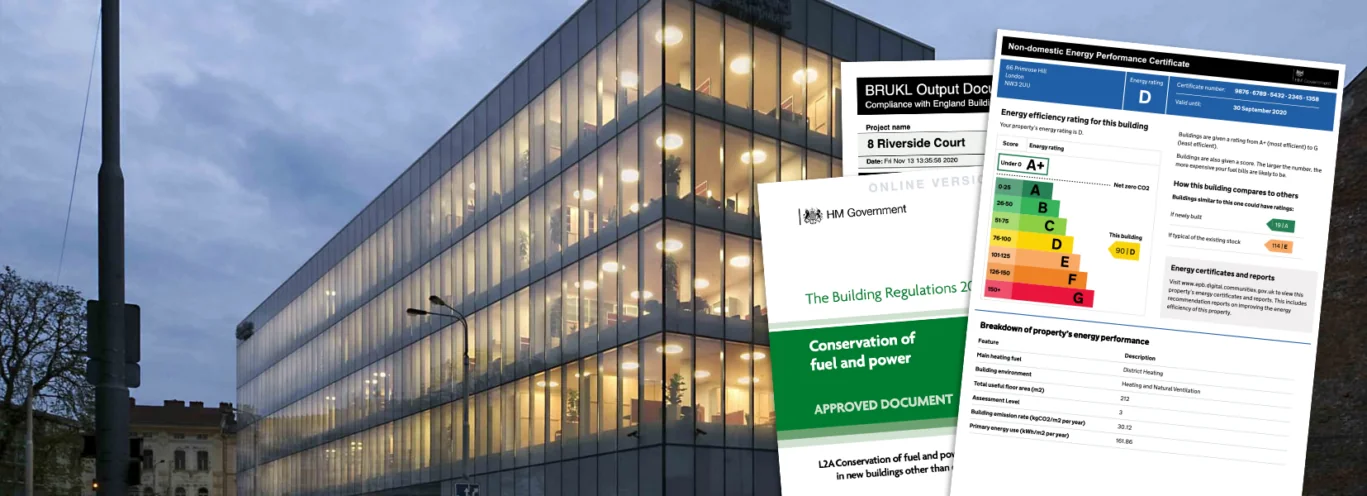

The UK’s domestic housing stock has a long way to go before the country will be able to meet its Net Zero target. One major obstacle which prevents homeowners from improving the energy performance of their houses is the financial cost of making such improvements. Thus, this must be overcome if the domestic sector is to make the necessary progress. These schemes are designed to address this problem.

Each one of these 26 projects is designed to make it possible for more people to improve the energy rating of their homes. Retrofitting energy measures needs to be accessible and affordable. These schemes ease the financial burden of making energy efficiency improvements. The upgrades made possible by these schemes could save people over £460 on their energy bills annually. Ideally, the rollout of these projects will lead to warmer, more efficient homes across the country.

Each of the individual green finance projects are unique and tailored to the companies and customers using them. The following are two examples of current projects:

The Perenna Bank Green Finance Project

Perenna Bank is developing a project which revolves around a long-term fixed mortgage. This will incentivise people to improve their homes by offering lower mortgage rates for houses with high energy-efficiency ratings. This will financially reward people for upgrading their homes.

The Ashman Bank Green Finance Project

Ashman Bank Ltd. homeowners will be able to incorporate the cost of certain improvements into their mortgage, which means that they will be able to borrow the money they need to install energy measures. Firstly, a Domestic Energy Assessor will produce an EPC, then a retrofit professional will provide options on how the property could be improved, then finally the bank will incorporate the cost of the improvements into the duration of the mortgage. The cost of the upgrades is therefore included in their monthly payments. This reduces the burden of the up front cost which they would otherwise have to pay all at once.

These are just 2 examples of 26 projects being developed and tested, backed by £4.1 million of government funding. If you would like to find out more about these projects, please read the government’s ‘Mortgage rate cut for energy efficient homes under government-backed trials’ press release.

The Timeline

The projects will continue in their current form for 6 months. During this time, the houses will be assessed and potential solutions will be considered and discussed. After this discovery period has elapsed, all 26 projects will be able to apply for larger grants to actually pilot their green finance products and services. Grants of anywhere between £200,000 – £2 million will be available.

An Experiment of Discovery

Additionally, these schemes serve a further purpose – they are acting as a sort of testing ground. The green finance projects will run like trials, to find out which funding structures are the most effective and what leads to the biggest and most sustainable improvements. This knowledge will be used to inform future projects as the country continues on its path to net zero.

This is yet another project which highlights the rapid growth of the energy industry. As the country hurtles towards its energy goals, more and more energy professionals are needed to carry out the work which the UK has undertaken. If you would like to be a part of this, please consider one of Energy Trust’s professional training courses. We’d be more than happy to get you started on your new career in energy. Book your space online, or give us a call at 0333 012 0002.